Return on Investment Write For Us

Return on Investment Write For Us – Return on Investment (ROI) is a financial metric used to evaluate the profitability of an investment relative to its cost. It measures the return or Profit generated from an investment compared to the money invested. ROI is stated as a percentage or a ratio, providing insights into the efficiency and profitability of an investment.

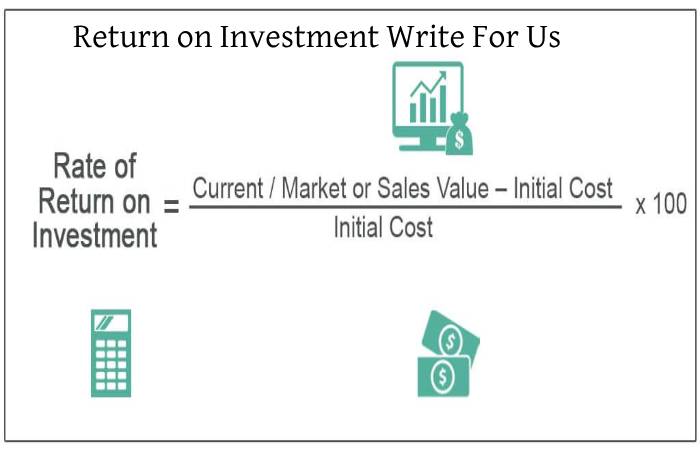

The ROI formula is as follows:

ROI = (Net Profit / Cost of Investment) x 100

Where:

- Net Profit refers to the total return or gain from the Investment.

- The cost of Investment represents the total amount of money invested.

A higher ROI indicates a more profitable investment, while a lower ROI suggests lower profitability. ROI is a widely used metric in finance and business decision-making processes, as it helps investors and managers assess the viability and attractiveness of various investment opportunities.

How to Submit Your Articles?

To submit your posts, you can email us to contact@globalmarkeingguide.com.

Why Write for Global Marketing Guide – Return on Investment Write For Us

- Global Marketing Guide can expose your website to customers looking for a Return on Investment Write For Us.

- Global Marketing Guide’s presence is on social media, and we will share your article with the – Return on Investment-related audience.

- You can reach out to Return on Investment enthusiasts.

Search Terms Related to Return on Investment

- Net Present Value (NPV)

- Internal Rate of Return (IRR)

- Payback Period

- Modified Internal Rate of Return (MIRR)

- ROI Ratio

- Capital Expenditure (CapEx)

- Operating Expenditure (OpEx)

- Discounted Cash Flow (DCF)

- Hurdle Rate

- Sensitivity Analysis

Search Terms Related To Return on Investment Write for Us

- writers wanted

- suggest a post

- submit the guest post

- looking for guest posts

- guest posts wanted

- guest posting guidelines

- contributor guidelines

- become an author

- become a guest blogger

- Write for us

- Guest Post

- Write For Us

- Submit post

- Submit an article

- Become a guest blogger

- Writers wanted

- Guest author

- Write for us tips

- Write for us guest blog

- Write for us + guest post

- Write for us “write for us”

- “Write for us” guest post

- “Write for us.”

Guidelines of the Article

- Global Marketing Guide welcomes fresh and unique content related to Return on Investment.

- Global Marketing Guide Tips allows at least 300+ words linked to Return on Investment.

- The editorial team of Global Marketing Guide does not encourage promotional content associated with Return on Investment.

- For publishing an article at Global Marketing Guide, please email us at contact@globalmarkeingguide.com.

- Global Marketing Guide allows articles related to Business, Marketing, startups, Money Apps, Finance And Loans, Mobile For Seniors, and e-commerce.

Related pages:

Sales Forecasting Write For Us

Testimonials Write For Us

Product Demonstration Write For Us