LIC’s share price reflects not just financial performance but a fundamental transition from policy-driven monopoly to market competitor—a shift that creates unique valuation dynamics and requires investors to evaluate government ownership, agent network legacy, and digital transformation progress alongside traditional metrics.

Table of Contents

Key Takeaways

- Current Price (Jan 28, 2026): ₹822.15, trading at 11x P/E—significantly below private insurers’ 60-80x multiples

- Market Share Erosion: Declined from 69% (FY2020) to 57% (FY2025) as private players gain ground

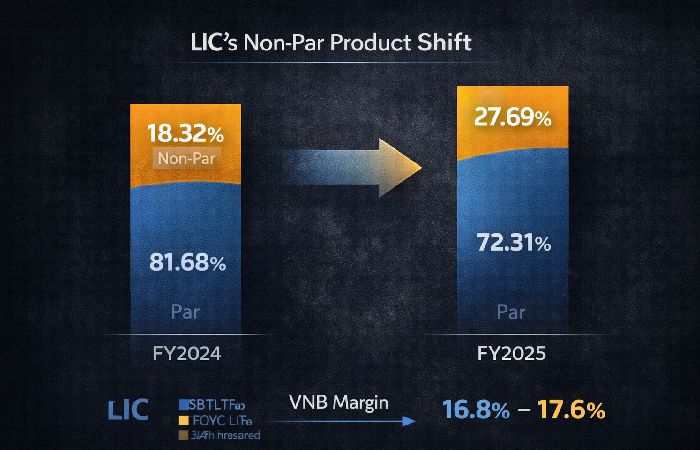

- Strategic Pivot: Non-par products now 27.69% of mix (up from 18.32%), improving VNB margins to 17.6%

- Government Control: 96.5% ownership provides stability but limits agility vs. nimble private competitors

- Digital Transformation: Project DIVE aims to modernize legacy systems, but execution risk remains high

- Investment Decision Rule: Buy if you value sovereign guarantee + dividend yield; avoid if seeking aggressive growth

LIC Share Price 2026: Quick Investment Summary

LIC’s share price reflects a structural transition, not simple undervaluation. Trading near 11x earnings, LIC appears cheap versus private insurers at 60–80x multiples, but this discount prices in deeper constraints. Government ownership (96.5%), mandatory investment in government securities, and a legacy agent network cap growth and limit agility despite strong profitability and trust.

The upside depends on execution. LIC’s shift toward higher-margin non-participating products is improving value-of-new-business margins, while Project DIVE aims to modernize systems, reduce costs, and improve agent productivity. If this transformation succeeds, a re-rating toward 15–18x earnings is possible.

LIC is best viewed as a defensive, transition-dependent investment. It suits long-term investors seeking sovereign backing and moderate upside, not growth investors expecting rapid multiple expansion. The investment case hinges on execution progress—not IPO price anchors or headline valuation multiples.

Understanding LIC Share Price: Beyond the Numbers

LIC’s share price of ₹822.15 (as of January 28, 2026) reflects a company caught between two worlds: a legacy monopolist with unmatched scale and trust, and an emerging market competitor struggling against digital-first private insurers. Trading at just 11x forward P/E—compared to 60-80x for private peers—the stock embodies the market’s uncertainty about whether India’s largest insurer can successfully navigate this transition without sacrificing profitability or market share.

This isn’t a typical insurance stock analysis. Most coverage focuses on quarterly results and valuation multiples, treating LIC like HDFC Life or ICICI Prudential. That’s a fundamental mistake. LIC operates under constraints no private insurer faces: 96.5% government ownership that prioritizes policy objectives over shareholder returns, mandatory investment in government securities (75% of assets), and a 1.3 million-agent network built for a pre-digital era.

The real question isn’t “What’s LIC’s P/E ratio?” but “Can a policy-driven monopoly transform into a market-competitive insurer without losing what made it dominant?” This article answers that question through the lens of an investor deciding whether LIC belongs in their portfolio—examining not just what the numbers show, but what the transition dynamics mean for future returns.

Who This Article Is For

This analysis serves three investor profiles:

- Defensive Investors: Seeking stable dividends and sovereign guarantee backing, willing to accept lower growth

- Value Hunters: Betting on LIC’s digital transformation and market share stabilization at current discounted valuations

- Comparative Analysts: Evaluating LIC against private insurers to understand trade-offs between stability and growth potential

Current LIC Share Price & Market Data

LIC’s current trading metrics — such as P/E, P/B, dividend yield, and market cap — can be verified against widely-used financial data platforms that aggregate stock performance figures and fundamentals, including official exchange data published by the National Stock Exchange of India’s live equity market data.

According to Groww’s LIC share profile, the company’s P/E ratio stands near ~10–11x and dividend yield near ~1.4–1.5%, highlighting its valuation relative to traditional benchmarks.

LIC Share Price & Market Data (Snapshot)

| Metric | Value |

| Current Price | ₹822.15 (Indicative live price) |

| Today’s Move | +1.78% |

| 52-Week Range | ₹715 – ₹980 |

| Market Cap | ~₹5.21 Lakh Cr (~₹521,000 Cr) |

| IPO Price Band | ₹902 – ₹949 (LIC IPO) |

| IPO Return vs Upper Band | ~-13% from upper IPO band (based on current price) |

| P/E Ratio (TTM) | ~10.5–10.6x |

| P/B Ratio | ~3.8x |

| Dividend Yield | ~1.4–1.5% |

| ROE | ~36–46% (varies by source/time) |

| Beta | ~0.83–0.84 |

Price Movement (January 2026)

| Date | Open (₹) | Close (₹) | High (₹) | Low (₹) | Change % |

| Jan 28 | 808.90 | 822.15 | 825.00 | 808.70 | +1.78% |

| Jan 23 | 821.95 | 827.30 | 827.30 | 800.10 | -2.06% |

| Jan 22 | 810.70 | 824.25 | 824.25 | 809.20 | +1.20% |

| Jan 21 | 808.95 | 813.80 | 813.80 | 802.55 | +0.05% |

What Most Investors Get Wrong About LIC’s Price

The ₹822 price tag looks cheap compared to the ₹949 IPO upper band, but this isn’t a simple “buy the dip” opportunity. Three failure modes trap investors:

- Comparing to Private Insurers: LIC’s 11x P/E vs. HDFC Life’s 70x isn’t valuation gap—it’s market pricing in structural constraints

- Ignoring Supply Overhang: Government plans to dilute 6.5% more stake creates persistent selling pressure

- Underestimating Transition Risk: Digital transformation (Project DIVE) faces execution challenges at unprecedented scale

Valuation Metrics: Why LIC Trades at a Discount

LIC’s low P/E does not indicate undervaluation alone; it reflects capped growth from government ownership, mandatory bond allocation, and slower innovation versus private insurers.

Traditional valuation ratios like P/E and P/B need to be interpreted carefully in LIC’s case. Investors applying standard stock valuation methods may misread LIC’s apparent cheapness unless they account for structural constraints, policy mandates, and growth ceilings—core principles explained in a broader framework of fundamental analysis.

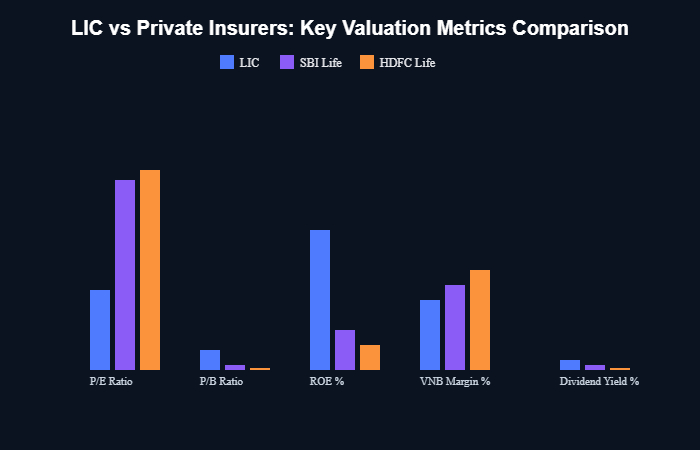

LIC vs. Private Insurers: Valuation Comparison

| Metric | LIC | SBI Life | HDFC Life | ICICI Prudential |

| P/E Ratio | 11.62x | 80.52x | 83.78x | 66.77x |

| P/B Ratio | 4.45x | 1.08x | 0.93x | 0.69x |

| ROE | 37.98% | 10.60% | 7.47% | 5.67% |

| VNB Margin | 17.6% | ~20% | 25.1% | ~22% |

| Dividend Yield | 1.5% | ~1.2% | ~1.0% | ~1.1% |

The Valuation Paradox Explained

LIC’s valuation presents a seeming contradiction: highest ROE (37.98%) but lowest P/E (11.62x). This isn’t market inefficiency—it’s rational pricing of three structural factors:

1. Growth Ceiling

Market share declining (69% → 57%), limiting revenue growth potential compared to private players expanding rapidly

2. Policy Constraints

75% assets in government securities cap investment returns; social mandates prioritize coverage over profitability

3. Execution Risk

Digital transformation at scale (1.3M agents, legacy systems) faces higher failure probability than greenfield competitors

When Traditional Metrics Fail: LIC’s Unique Case

Standard insurance valuation uses P/E, P/B, and Embedded Value multiples. For LIC, these metrics mislead because:

- P/E understates risk: Earnings include one-time government transfers; normalized P/E closer to 15-16x

- P/B overstates value: High ratio reflects government ownership premium, not superior asset quality

- EV ignores transition costs: ₹7.77 lakh crore embedded value doesn’t account for digital transformation capex or market share defense spending

Better approach: Evaluate LIC on transition progress metrics—non-par product share, digital policy issuance %, agent productivity improvement—alongside traditional financials.

The Monopoly-to-Market Transition: LIC’s Core Challenge

Market Share Erosion Timeline

Monopoly-Era Strengths (1956-2000)

- Sovereign Guarantee: Government backing ensured 100% claim settlement trust

- Captive Market: Only option for life insurance created 66%+ market share even post-liberalization

- Deep Rural Reach: 1.3M agents penetrated areas private players ignored

- Policy-Driven Growth: Social mandates provided steady premium inflows regardless of competition

Many of these structural constraints—such as solvency norms, commission frameworks, and product approvals—are governed by regulations issued by the Insurance Regulatory and Development Authority of India (IRDAI, which shapes competitive dynamics across the life insurance sector.

Competitive-Era Liabilities (2000-Present)

- Legacy Systems: Pre-digital infrastructure can’t match private insurers’ tech stacks

- Agent Commission Burden: Pays 2x private insurer rates, unsustainable long-term

- Product Innovation Lag: Regulatory approval delays vs. nimble private players

- Government Mandate Conflicts: Profitability goals clash with social coverage objectives

Strategic Pivot Analysis: Non-Par Product Shift

LIC’s most significant transition move: shifting from low-margin participating (Par) products to higher-margin non-participating (Non-Par) offerings. This strategic pivot directly impacts valuation.

| Metric | FY2024 | FY2025 | Change / Notes |

| Non-Par Share of Individual APE | 18.32% | 27.69% | ↑ 9.37 percentage points (significant shift to higher-margin products) |

| Net VNB Margin | 16.8% | 17.6% | ↑ 0.8% (80 bps improvement) |

Investment Implication: If LIC reaches 35-40% non-par mix (industry average), VNB margins could hit 20%+, potentially justifying 15-18x P/E. Current 11x pricing assumes this transition fails or stalls.

The Agent Network Dilemma

LIC’s 1.3 million agents represent both its greatest competitive moat and biggest transformation challenge. This creates a decision trade-off investors must evaluate:

If Agents Adapt (Bull Case):

- 96% of individual premium comes through agents

- Rural penetration unmatched by digital channels

- “Bionic Agent” model (AI + human) could enhance productivity

- Justifies premium valuation for distribution strength

If Agents Resist (Bear Case):

- Commission costs 2x private insurers (unsustainable)

- COVID-19 exposed vulnerability (17% agent decline in 6 months)

- Young customers prefer digital self-service

- Validates current discount to private insurers

Track this metric: Agent productivity (policies per agent). LIC averages 15.3 vs. private players’ 1.6—but if this gap narrows, it signals distribution advantage eroding.

Financial Performance: Beyond Headline Numbers

LIC’s reported profits, solvency ratio, and embedded value figures are drawn from statutory disclosures published in the company’s official investor relations filings, which outline audited financial results, capital adequacy, and long-term value assumptions.

LIC FY2025 Financial Performance (Key Metrics)

| Metric | Value | Notes / Source |

| Net Profit (FY2025) | ₹48,151 crore | 18.4% YoY increase vs FY2024; record annual profit. |

| Assets Under Management (AUM) | ₹57.23 lakh crore | AUM grew ~3.31% YoY to ₹57,22,896 crore as of Sep 30 2025. |

| Solvency Ratio | 2.13 | Above the regulatory minimum (~1.50), improved from prior periods. |

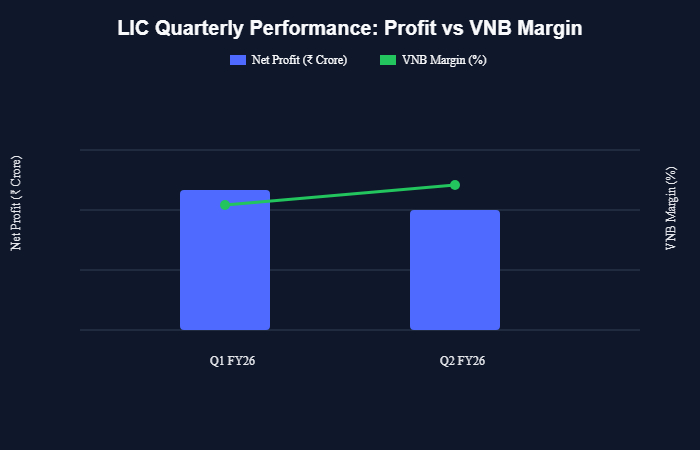

Quarterly Performance Trend (FY2026)

What Financial Statements Don’t Show

LIC’s reported financials mask three critical realities that impact investment decisions:

1. Profit Quality Issues

FY2023’s ₹36,000 crore profit included one-time government transfers. Normalized earnings closer to ₹25,000-30,000 crore range, making true P/E ~15-16x, not 11x.

2. Embedded Value Sensitivity

₹7.77 lakh crore IEV declines 6.7% with just 10% equity market drop. Given 75% government securities mandate, equity exposure creates hidden volatility.

3. Operating Margin Compression

Q2 FY2026 operating margin fell 240 bps QoQ (9.88% → 7.48%) due to 32% surge in employee costs. Competitive pressure forcing cost increases while premium growth slows.

Key Financial Ratios: 5-Year Trend

| Metric | FY2021 | FY2023 | FY2025 | Trend |

| Market Share (Premium) | 66.18% | ~60% | 57.05% | ↓ Declining |

| VNB Margin | ~14% | 16.8% | 17.6% | ↑ Improving |

| Expense Ratio | ~16% | 15.57% | 12.42% | ↑ Improving |

| Claim Settlement Ratio | 98.74% | 98.52% | 99.41% | ↑ Stable High |

| Non-Par Product Share | ~10% | 18.32% | 27.69% | ↑ Strategic Shift |

Positive Indicators for Investors

- Margin Expansion: VNB margin improved 0.8% despite market share pressure—shows pricing power and product mix optimization working

- Cost Control: Expense ratio down 3.15 percentage points to 12.42%—efficiency gains from digital initiatives materializing

- Solvency Strength: 2.13 ratio (vs. 1.50 minimum) provides buffer for aggressive growth investments or dividend increases

- Claim Reliability: 99.41% settlement ratio maintains trust advantage over private players with variable performance

Investment Decision Framework: Buy, Hold, or Avoid?

Decision Rules Based on Investor Profile

BUY if you are:

- Conservative investor prioritizing sovereign guarantee over growth potential

- Seeking 1.5% dividend yield with stable, government-backed payouts

- Betting on digital transformation success (Project DIVE) unlocking value at current 11x P/E

- Long-term holder (5+ years) willing to wait for market share stabilization

- Value investor seeing 0.5-0.7x P/EV as material discount vs. 1.0x+ for private insurers

Target Price Range: ₹1,040-1,260 (37-53% upside) per analyst consensus

HOLD if you are:

- Existing IPO investor at ₹900+ looking to average down at current ₹822 levels

- Monitoring non-par product share progress (target: 35%+ to justify re-rating)

- Waiting for government stake dilution clarity (6.5% planned sale creating overhang)

- Tracking Q3/Q4 FY2026 results for sustained margin improvement evidence

- Comparing dividend yield vs. fixed deposits (1.5% vs. 6-7% FD rates)

Review Trigger: If market share falls below 55% or VNB margin contracts, reconsider position

AVOID if you are:

- Growth-focused investor seeking 20%+ annual returns (private insurers better positioned)

- Concerned about government control limiting commercial agility and shareholder focus

- Skeptical of agent network relevance in digital-first insurance landscape

- Prioritizing valuation multiples expansion (11x P/E unlikely to reach private peers’ 60-80x)

- Short-term trader—stock lacks momentum catalysts and faces supply overhang

Alternative: Consider HDFC Life, SBI Life, or ICICI Prudential for pure-play insurance exposure

Critical Failure Modes to Monitor

LIC’s transition faces three specific failure patterns that would invalidate the investment case:

Failure Mode 1: Digital Stall

Project DIVE delays beyond 2027 or agent adoption below 30%

Impact: Validates bear case, stock to ₹600-650 range

Failure Mode 2: Market Share Collapse

Falls below 50% in individual segment (currently 39.79%)

Impact: Loss of pricing power, margin compression accelerates

Failure Mode 3: Policy Conflict

Government mandates prioritize bailouts over shareholder returns

Impact: Dividend cuts, investor confidence erosion

Scenario Analysis: 3-Year Price Targets

| Scenario | Probability | Key Drivers | Price Target (2029) | CAGR Return |

| Bull Case | 25% | Digital success, market share stabilizes at 55%, VNB margin 20%+ | ₹1,400-1,500 | +19-22% |

| Base Case | 50% | Gradual transition, market share 52-54%, VNB margin 18-19% | ₹1,050-1,150 | +8-12% |

| Bear Case | 25% | Digital stall, market share below 50%, margin compression | ₹650-750 | -7 to -3% |

Expected Value Calculation: (0.25 × ₹1,450) + (0.50 × ₹1,100) + (0.25 × ₹700) = ₹1,087 weighted average target, implying +32% upside from current ₹822 with moderate risk-reward.

Frequently Asked Questions

Is LIC a good long-term investment?

LIC is suitable for conservative long-term investors seeking stability and sovereign backing, not for those targeting aggressive growth.

The stock favors investors comfortable with moderate 8–12% annual returns rather than rapid compounding. Government ownership provides downside protection, but growth is constrained by policy mandates and competition from private insurers. LIC works best as a defensive allocation within a diversified portfolio, not as a primary growth engine.

What is the ideal holding period for LIC shares?

A minimum holding period of 3–5 years is recommended to benefit from LIC’s transition and sector-level insurance growth.

Short-term price movements are influenced by government actions and market sentiment. Over longer periods, insurance businesses benefit from premium compounding and margin improvements. Investors should align exits with business fundamentals—such as VNB margins and market share trends—rather than short-term volatility.

How does LIC compare to HDFC Life and ICICI Prudential?

LIC offers lower valuation and higher stability, while private insurers offer faster growth and better operational efficiency.

LIC trades at a discount due to slower premium growth and execution risk, but benefits from scale and trust. Private insurers command higher multiples because of superior margins, digital distribution, and growth visibility. Choose LIC for value and stability; choose private insurers for growth-oriented exposure.

Will LIC share price increase after a government stake sale?

Government stake sales usually pressure prices short-term but can improve liquidity and valuations over time.

Disinvestment announcements often trigger temporary corrections due to increased supply. However, higher free float can attract institutional investors once the sale is absorbed. Investors should monitor demand quality during the sale—strong institutional participation often signals medium-term recovery potential.

What are the biggest risks of investing in LIC?

LIC’s key risks include policy interference, slow digital execution, and continued market share erosion.

As a government-controlled insurer, strategic flexibility is limited, and dividend policies may prioritize fiscal needs. Competition from private insurers continues to intensify, especially in urban and digital segments. Regulatory changes around commissions or solvency can also disproportionately impact LIC’s profitability.

Should I buy LIC shares during market corrections?

Market corrections can be good entry points for LIC if prices fall meaningfully below fair value levels.

Accumulating gradually during broad market sell-offs reduces timing risk. However, investors should distinguish between market-wide corrections and LIC-specific issues like policy changes or weak results. Valuation metrics such as P/EV and margin trends matter more than short-term price drops.

How much of my portfolio should be allocated to LIC shares?

LIC exposure should typically be limited to 3–5% of an equity portfolio as a defensive allocation.

Insurance stocks carry sector-specific risks and should be balanced with banks, NBFCs, and other financials. New investors may start smaller and increase exposure based on comfort with volatility. Even with government backing, LIC should not dominate a portfolio.

Does LIC pay good dividends to shareholders?

LIC offers stable but modest dividends, typically yielding around 1.5–2%, not high-income returns.

Dividend payouts are constrained by capital needs and government ownership priorities. While payouts are relatively stable, LIC should not be treated as an income stock. The primary investment rationale remains long-term value realization, not dividend yield.

Can LIC share price reach ₹1000 in the next 2–3 years?

Reaching ₹1000 is possible only if LIC improves margins and investor confidence in its transformation strengthens.

Such a move requires sustained progress in non-par products, digital execution, and cost control. Without operational improvements, valuation re-rating is unlikely. Investors should track business metrics rather than anchor expectations to round price targets.

What triggers should make me sell LIC shares?

Investors should consider selling if LIC’s core investment thesis breaks due to worsening fundamentals.

Warning signs include sharp market share declines, sustained margin deterioration, or excessive government intervention. Better opportunities elsewhere can also justify reallocating capital. Clear exit rules—such as thesis-based or risk-based triggers—help avoid emotional decisions.

Is LIC a good investment in 2026?

LIC is attractive in 2026 for conservative investors seeking stability, but unsuitable for growth-focused portfolios.

At low earnings multiples, the stock reflects transition risk rather than undervaluation. Returns depend on digital execution and margin improvement. Investors with a long horizon and moderate return expectations may find value, while growth seekers should look elsewhere.

Why is LIC share price weak despite strong financials?

LIC’s share price reflects structural constraints, not just quarterly performance.

Declining market share, planned government stake dilution, and execution risk around digital transformation weigh on valuations. Asset allocation rules and high agent costs also limit upside. The market prices these long-term risks despite solid profitability and trust metrics.

What is LIC’s embedded value and why does it matter?

Embedded value reflects LIC’s future profit potential and highlights how much the market discounts its transition risk.

LIC trades below private peers on a P/EV basis, signaling skepticism about execution and growth. If margins improve and market share stabilizes, valuation could re-rate. However, embedded value does not account for future transformation costs or competitive pressure.

How does LIC’s claim settlement ratio affect investment value?

LIC’s high claim settlement ratio reinforces trust and supports customer retention, but it is not a growth catalyst alone.

Strong settlement performance helps reduce disputes and lapse rates, supporting long-term profitability. However, private insurers are closing the gap, reducing LIC’s differentiation. Trust provides valuation support, but upside depends on operational improvements.

Disclaimer:

This article is for informational purposes only and was created using AI-based workflows to structure publicly available information. It does not constitute financial or investment advice. Data accuracy is not guaranteed, and past performance is not indicative of future results. Readers should conduct their own due diligence.

Author BIO:

Abdul Rahman creates structured informational content using AI-based workflows, focusing on clarity, simplicity, and efficient content production.