Table of Contents

Investment Portfolio Definition

An investment portfolio is that combination of financial assets in which a basket of financial assets deposit with the idea of generating a capital gain. Also known as a portfolio.

In a more widespread way, we call an investment portfolio or a securities portfolio to that group of assets in which we have invested money in a diversified manner. It is the basket of assets in which we invest.

Suppose we invest in fixed income or variable income. In that case, these assets can fix if we decide to invest in variable nature assets, which are the vast majority of financial support (stock market, investment funds, etc.). Naturally, there are mixed investment portfolios, which make up of the two previous types.

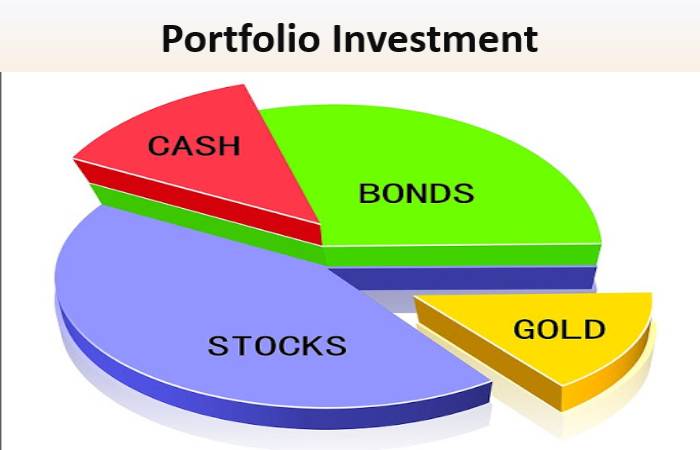

In contrast to what believe, a portfolio is not composed solely of shares publicly traded. But all kinds of assets from mutual funds, stock indexes, currencies, and commodities.

Furthermore, Portfolio management is the selection, prioritization, and control of an organization’s programs and projects, in line with its strategic objectives and capacity to deliver. The goal is to balance the implementation of change initiatives and the maintenance of business-as-usual while optimizing return on investment.

Composition of an Investment Portfolio

The composition of a portfolio is derived based on the investor’s profile. It can be conservative, medium or risky, depending on the risk and volatility that the investor is willing to assume.

And the final profitability we obtain will depend on the composition of the securities or investment portfolio. It based on the proportionality of each asset’s weight in the portfolio.

We can distinguish two types of the portfolio based on the temporality of the assets:

Loan portfolio: It is one in which we maintain the investment for a long time to achieve long-term profitability.

Debt portfolio: We decide to invest in short-term assets, so-called because they generally borrow to buy and sell assets quickly.

Example of an Investment portfolio

There can be very different types of assets such as bonds, futures, mutual funds, CFDs and stocks, among other financial assets in investment portfolios. But it can also be made up of a single type of investment. For example, this would be a portfolio composed only of stocks.

Types of Investment Portfolio

The investment portfolio allows you to combine financial assets to generate a capital gain. An investment portfolio or portfolio of securities comprises a set of assets in which money is diversified invested.

They can be assets of a different nature, such as fixed income or equities, and other financial assets. Or a combination of several different instruments called mixed investment portfolios.

A portfolio can also make up shares and other assets, such as investment funds, stock indices or currencies, and raw materials. So the more diversified it is, the better and more varied opportunities it will have.

How to Configure our Investment Portfolio?

When configuring our investment portfolio, we choose a series of assets to achieve an economic return.

Although the investment portfolio concept is often directly related to investment in the stock market. The truth is that among the assets that we can include in our portfolio, almost any economic tool that helps us increase our support can consist.

Thus, we can consider investing in financial products such as time deposits, public debt securities, pension plans, investment funds, stocks, derivatives, etc. Other activities can also bring us a profit: the purchase-sale of real estate, investment in companies, etc.

Whatever the assets we want to make up our investment portfolio, we will need to carry out a preliminary analysis of different factors. A carry out reasoned planning of our decisions and financial movements. To do this, we can follow some guidelines and take into account some key aspects. We will see them briefly below:

1. Define our Investor Profile

- Before thinking about what we will invest in, we must analyze ourselves and know ourselves as investors.

- To do this, we will have to define our investor profile about our ability to tolerate risk: conservative, moderate or aggressive.

- Once this does, we can find the financial assets that best suit our needs.

2. Set our Financial Goals

- Once we have determined the risks that we are willing to assume in our investments, we must set a goal. Why invest? To buy a house, enjoy greater peace of mind during retirement, meet the children’s studies’ expenses, etc.

- Ideally, with these goals in mind, we would establish a profit range or a percentage of profitability to achieve those objectives.

3. In How Long?

- In the previous step, we will have established a series of financial goals. Now, we must set a timetable for its achievement.

- A balanced investment portfolio should contemplate different financial objectives in the short, medium and long term (approximately: less than 12 months, from 12 months to 5 years and more than five years).

- These data will also help us in choosing the assets that will make up our portfolio. At this point, it must take into account that, in general terms, the longer the time, the greater the profitability offered by investment products.

4. Choose the Assets that will Make up our Portfolio

- Depending on our risk tolerance, our profitability expectations and our time horizons. We may begin to assess incorporating a series of financial products or other types of assets into our portfolio.

- We will have to assess the conditions offered by each product or each option, determine their real returns, the level of risk they entail. The time in which we will recover the investment, etc.

- This way, we will know whether or not they adjust to the needs and objectives set in our savings and investment plan.

5. Diversify

- In addition to valuing each of our assets individually, we also have to consider how they work together when setting up our portfolio.

- Here the concept of diversification comes into play. Whatever our investor profile, we must combine assets that present different risk levels to build a balanced investment portfolio.

- As we well know, the level of profitability offered by investment is directly proportional to the risk involved. With this in mind, the idea presented by diversification would be to neutralize the high level of risk of some financial products by including other safer savings options in the portfolio.

- A done correctly, our portfolio will present an optimal potential return, reducing all our investments’ overall risk level. Or put more simply, we will avoid putting all the eggs in the same basket.

- If we are strict when determining each product’s maximum and minimum returns. And balance risks well, we will achieve, even in the worst possible scenario, not to lose money.

6. Consider Investment Expenses

- If when evaluating an investment option the first thing we look at is the benefits and the risk, no less important are the associated expenses that this entails: commissions, management, maintenance, transmission, and advice, etc.

- Let us also bear in mind that financial products are subject to taxation, so their tax will be another aspect to be analyzed.

- To obtain the maximum profitability with our investments, we will have to calibrate these expenses to know each product’s net profitability.

- An investment will never be adequate if these associated expenses significantly undermine the promised return.

Conclusion

An investment portfolio is the set of assets with which an investor or saver carries out his financial strategy. It is the set of financial products and goods to which the saver allocates his money to obtain a return for it.

The investment portfolio concept introduces our investments’ global vision, considering the correlations between the different assets.

Thus, we can get an idea of the overall profitability that our portfolio can offer us. And it also helps us make strategic decisions. Today we will know a little better what an investment portfolio is and what we must consider when setting up our own.