Cochin Shipyard remains a fundamentally strong PSU shipbuilder, but current valuations appear stretched amid margin pressures and elevated expectations. At present levels, the risk-reward looks unfavourable for fresh entries, while existing investors may evaluate partial profit-booking.

Table of Contents

## Quick Verdict: Buy, Sell, or Hold?

Verdict (Next 12 Months): High‑quality PSU, but Overvalued – Prefer “Wait / Partial Profit‑Booking”

- Cochin Shipyard Limited (COCHINSHIP) delivered solid Q3 FY26 revenue growth, but profits and margins dropped sharply, highlighting cost and mix pressures just as the stock is trading at a rich valuation.

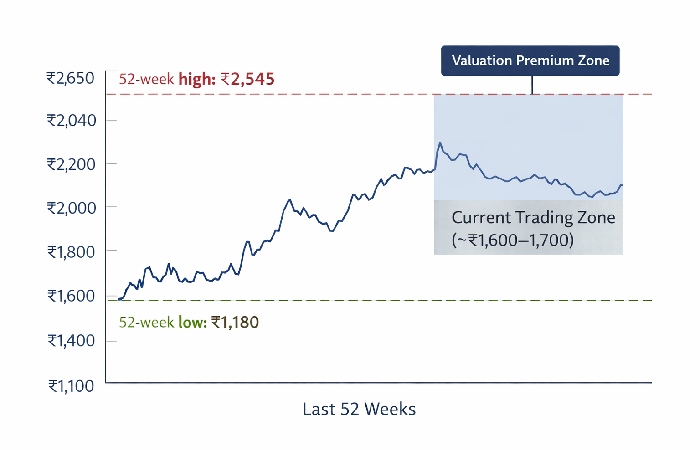

- Around ₹1,660 on 30 January 2026, its trailing P/E is in the 50x–60x band depending on the source, a clear premium to many defence and PSU peers.

- The recent 2–3% bounce is driven by a new “Green Tug” order (₹100–250 crore band) plus a ₹3.50 interim dividend, but these positives do not fully offset the stretched valuation and near‑term margin squeeze.

Simple stance:

- New investors: Wait for better valuations or clearer margin recovery.

- Existing investors: Hold if long term, consider partial profit‑booking if heavily in profit or overweight.

## Snapshot: Cochin Shipyard Share in Late Jan 2026

| Metric | Value / Comment |

| CMP (30 Jan 2026) | Closed at ₹1,660.60; day range ₹1,575.00 – ₹1,666.00. |

| 52‑Week High / Low | ₹2,545.00 / ₹1,180.20. |

| Market cap | Around ₹43,650 crore at CMP. |

| TTM P/E | About 60.0x on trailing earnings. |

| Q3 FY26 revenue | ₹1,350.40 crore, up 17.7% YoY. |

| Q3 FY26 PAT | ₹144.60 crore, down 18.3% YoY. |

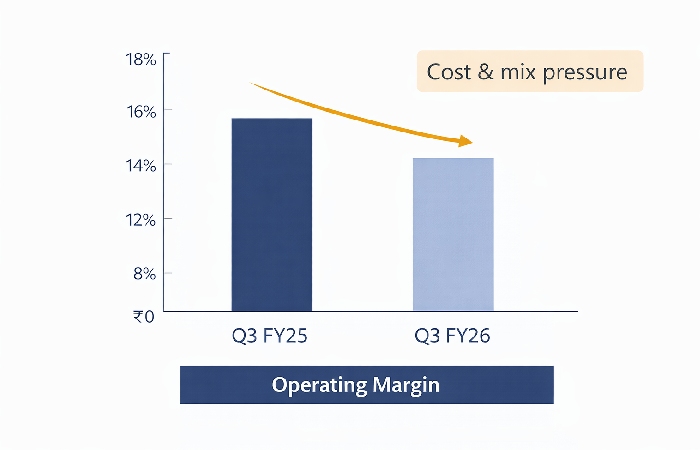

| Operating margin | Around 13.8% vs ~20.7% a year earlier. |

| Dividend | Second interim dividend of ₹3.50/share; record date 3 Feb 2026, payout by 26 Feb 2026. |

| Promoter holding | 67.92% (Government of India) as of Dec 2025. |

For live prices, volumes and the latest filings, you can always cross‑check Cochin Shipyard data on the official NSE India quote page for COCHINSHIP.

## Should You Buy, Hold, or Sell Cochin Shipyard?

### Guidance for new investors

- The business story is attractive: strong defence positioning, a large order book and visible government support, but Q3 FY26 shows the classic shipbuilding issue of revenue up, profit down.

- With P/E already elevated and other defence/PSU names available at lower multiples relative to ROE and growth, you risk paying for future execution that has not yet shown up in margins.

For investors applying disciplined fundamental analysis, the key question is whether future margin recovery is strong enough to justify today’s elevated P/E.

Action: Wait for either a meaningful price correction or evidence of sustained margin recovery before taking fresh positions.

### Guidance for existing investors

- The long‑term structural story—India’s defence build‑out and maritime push—stays intact, and Cochin Shipyard continues to pay dividends and win new orders like the Polestar Maritime green tugs.

- However, with earnings under pressure and valuation rich, the margin for error is small; another weak quarter could trigger further de‑rating.

Action: Long‑term investors can hold, but if you are significantly in profit or very overweight, booking partial gains and re‑entering on dips is a prudent approach.

## Why the Indian shipbuilding sector matters in 2026

India’s shipbuilding sector is in a structural upcycle, supported by the government’s long‑term maritime vision documents like Maritime India Vision 2030 and broader “Amrit Kaal” blue‑economy plans, which aim to scale domestic shipbuilding, repair capacity and logistics competitiveness.

India currently has less than a 1% share of global shipbuilding orders, while China, South Korea and Japan dominate, but handles most of its trade volume by sea, making maritime capability a strategic priority.

Recent policy moves include expanded shipbuilding financial‑assistance schemes, incentives for green and specialized vessels, and steps to improve port infrastructure and financing, all of which indirectly benefit Cochin Shipyard and peers.

Industrial clusters in coastal states like Kerala and Tamil Nadu are being promoted to attract allied industries—component suppliers, repair facilities, and R&D hubs—making the ecosystem more competitive globally.

## Q3 FY26: revenue up, profit down

### Q3 FY26 key numbers

For the quarter ended December 2025 (Q3 FY26):

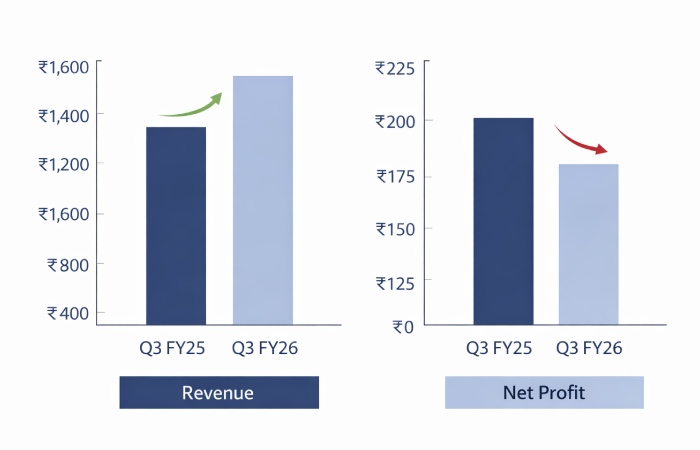

- Revenue: around ₹1,350 crore vs ~₹1,147 crore in Q3 FY25, a YoY growth of roughly 17–18%.

- EBITDA: about ₹186–187 crore vs ~₹238 crore a year earlier, a decline of around 21–22%.

- Net Profit: approximately ₹144–145 crore vs ~₹177 crore last year, down about 18%.

- Operating margin: compressed to about 13.8% from ~20.7% YoY, a drop of roughly 690 basis points.

| Metric | Q3 FY26 (₹ Cr) | Q3 FY25 (₹ Cr) | YoY Change |

| Revenue | ~1,350 | ~1,147 | ~+17–18% |

| EBITDA | ~187 | ~238 | ~–21–22% |

| PAT | ~145 | ~177 | ~–18% |

| Operating margin | ~13.8% | ~20.7% | –~690 bps |

These numbers align with the company’s filings and are echoed by major business media such as CNBC‑TV18’s Q3 coverage and multiple result analyses.

### Why did margins collapse?

- Higher input and subcontracting costs on complex shipbuilding contracts weighed on profitability.

- Finance costs rose as working‑capital requirements increased amid a high‑rate environment in India, which several result notes explicitly call out.

- A larger share of profitability came from other income, which is not a durable driver of long‑term earnings quality.

In essence, execution is continuing—revenue is growing—but at lower margins, and investors worry this trend could persist unless the mix tilts back toward higher‑margin repair and specialized work.

## Order book, green tug order and execution signals

### The ₹21,100 crore order book

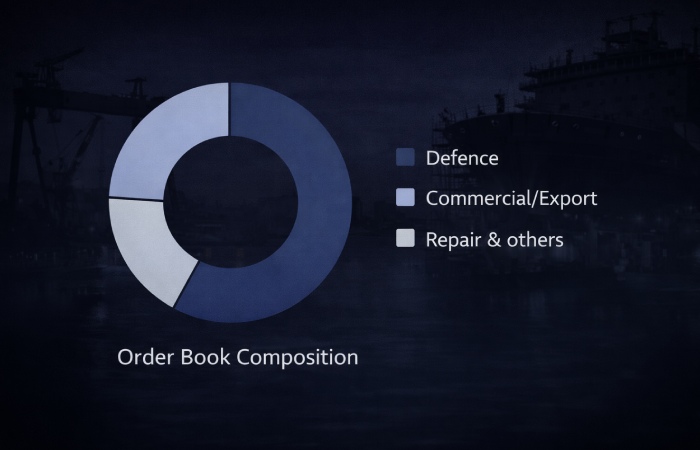

Multiple broker and portal write‑ups point to an order book above ₹21,000 crore, spanning defence, commercial and ship‑repair.

- Defence (around 70% by several estimates): includes anti‑submarine warfare corvettes, next‑generation missile vessels and other major naval platforms.

- Commercial and export: driven partly by Udupi Cochin Shipyard (UCSL), which has secured international orders, including low‑emission and zero‑emission vessels for European clients.

This order book gives a multi‑year revenue runway, but conversion into high‑margin earnings depends on execution mix and timelines.

| Segment | Approx share of order book | Notes |

| Defence | ~70–80% | NGMV, ASW corvettes and other naval orders. |

| Commercial/export | Remainder | UCSL‑led exports, specialized and low‑emission vessels. |

| Repair/others | Smaller share today | Expected to grow via ISRF and new dry dock capacity. |

### The Polestar Maritime green tug order

On 30 January 2026, Cochin Shipyard disclosed a notable domestic order from Polestar Maritime for two 60‑ton Bollard Pull green tugs, with total contract value in the ₹100–250 crore band and deliveries scheduled around late 2027. The stock gained about 3.1% on the day, closing near ₹1,660.60, as the order and interim dividend news partly offset concerns over Q3 FY26 margin compression.

India’s Green Tug Transition Programme (GTTP) aims to convert at least 50% of tugs at major ports to green variants by 2030, with phased procurement starting 2024; as an early mover through Cochin Shipyard and its UCSL subsidiary, CSL is well placed to capture a meaningful share of this emerging domestic market.

- The stock reacted positively, rising about 2–3% on the news as reported by outlets like CNBC‑TV18’s market update and other market news platforms.

- This order supports the “green vessel” thesis and should qualify for policy support under India’s green‑shipping and financial‑assistance initiatives, in line with global trends noted by bodies such as the International Maritime Organization on decarbonisation.

### Udupi and ship repair as earnings levers

Coverage of Cochin Shipyard’s strategy frequently highlights:

- Expansion at Udupi Cochin Shipyard to handle more commercial and export orders, with recruitment drives hinting at capacity ramp‑up.

- The International Ship Repair Facility (ISRF) in Kochi as a key margin driver, since ship repair typically carries higher margins than newbuilds and can smooth cyclicality.

Cochin Shipyard has also brought onstream two major assets at Kochi: the International Ship Repair Facility (ISRF) at Willingdon Island, a roughly ₹970 crore project with a shiplift system capable of handling around 80 ships a year, and a new 310‑metre dry dock designed for large LNG carriers and major naval vessels. These facilities significantly expand high‑margin repair capacity and allow India to retain work that previously went to foreign yards.

If these pieces execute to plan, they can gradually lift blended margins and reduce reliance on lumpy, lower‑margin legacy projects.

## Management shift: new CMD in 2026

From 31 January 2026, Director (Finance) V.J. Jose takes over as Chairman and Managing Director, succeeding long‑time CMD Madhu S. Nair, under whose tenure CSL delivered India’s first Indigenous Aircraft Carrier. The internal promotion suggests continuity in strategy, with investors expecting more emphasis on cost control and efficient ramp‑up of new facilities in the coming years.

## Valuation and scenario thinking

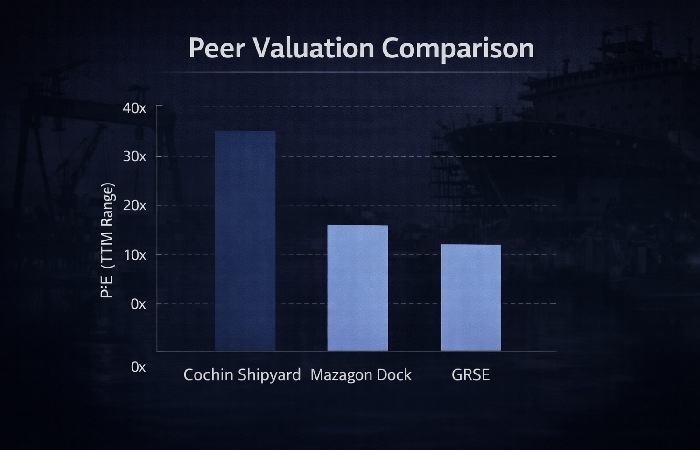

Live‑data platforms like Moneycontrol’s Cochin Shipyard page, Screener and Smart‑Investing all show Cochin Shipyard trading at a substantial premium on trailing P/E compared with several other PSUs and shipbuilders.

This valuation premium is similar to what we recently analysed in our detailed LIC share price analysis, where rich multiples also raised questions around margin of safety for new investors.

| Metric | Cochin Shipyard | Mazagon Dock | GRSE | Comment |

| P/E (TTM) | ~50–60x | Lower band | Lower band | CSL trades at a clear premium on earnings multiples. |

| ROE (approx) | Low‑mid teens | Higher | Mid | Peers often deliver equal or better ROE. |

| Dividend yield | Modest | Modest | Modest | All are dividend‑paying defence PSUs. |

Most cautious fundamental notes at present lean closer to base‑with‑valuation‑risk, rather than a clean bull case at this price.

### How Cochin Shipyard compares to PSU peers

At around ₹1,660, Cochin Shipyard trades at a trailing P/E in the 50x–60x band, which is a clear premium to many defence and PSU shipyard peers. This premium suggests the market is already pricing in strong order book execution, margin improvement, and continued defence spending tailwinds.

For investors, the key questions are:

- Does Cochin Shipyard’s execution record and order book justify this premium versus other PSU shipbuilders and defence names?

- Is there enough earnings growth visibility over the next 2–3 years to sustain or expand this valuation, or is mean reversion more likely?

If you are valuing conservatively, it makes sense to demand either:

- A better entry price that narrows the valuation gap with peers, or

- Clear evidence of margin recovery and faster profit growth that supports current multiples.

### Bear, base and bull cases

To keep things simple for retail investors, here is a quick scenario view for the next 12–24 months.

- **Bear case:** Order execution slows, margins stay under pressure, and the market derates high‑P/E defence PSUs.

In this scenario, Cochin Shipyard could see time correction and price downside as the valuation premium versus peers compresses. - **Base case (most likely):** Execution remains broadly on track, margins gradually recover from current pressure points, and defence / shipbuilding sentiment stays constructive.

The stock may deliver moderate returns largely driven by earnings growth rather than further P/E re‑rating.

- **Bull case:** Faster‑than‑expected execution of the current order book, strong new orders (including exports / green vessels), and a supportive PSU / defence sentiment keep valuations elevated.

Here, upside could come from both earnings growth and a sustained premium multiple, but this scenario requires several things to go right simultaneously.

For position sizing, it usually makes sense to assume the base case, be prepared for the bear case, and treat the bull case as optional upside rather than a guarantee.

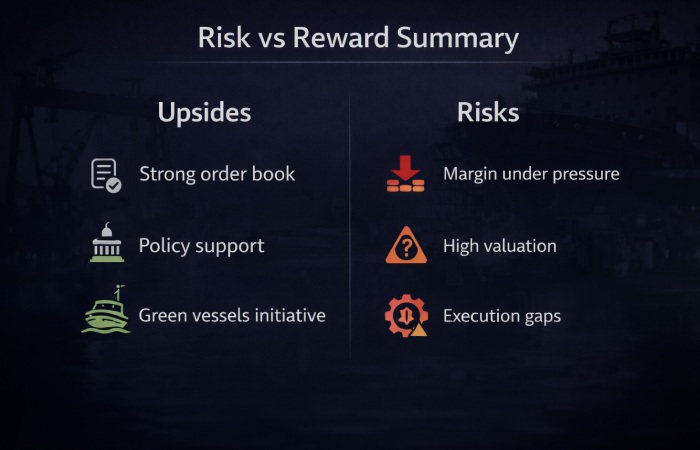

## Key upsides vs key risks

### Reasons to like Cochin Shipyard

- Strong order visibility: Order book above ₹21,000 crore gives multi‑year revenue assurance.

- Policy support: Beneficiary of India’s maritime and defence push, including shipbuilding assistance and green‑vessel incentives from the Ministry of Ports, Shipping and Waterways and related schemes outlined in official maritime policy documents.

- Green & specialized positioning: Green tugs and low‑emission vessels provide an edge in a niche that governments and global clients are supporting.

- Conservative balance sheet: Debt levels remain modest relative to equity, which is highlighted favourably in several fundamental screens.

- Dividend and PSU backing: Regular dividends (e.g., the ₹3.50 interim) and government ownership provide comfort to conservative investors.

### Key risks you should not ignore

- Margin compression: Q3 FY26 proved that even with strong revenue growth, margins can fall sharply, dragging profits down.

- Valuation risk: A P/E in the 50x–60x band is demanding for a cyclical, capital‑intensive business; any disappointment on margins or order execution could trigger a valuation reset.

- Execution risk on capex: New facilities such as greenfield yards and major repair projects must be executed on time and on budget; delays can weigh on returns.

- Project and contract risk: Complex defence and export contracts, plus legacy passenger‑vessel issues flagged in past filings, can lead to cost overruns or disputes.

- Global competition: Chinese and Korean yards still lead on scale and cost, which is well documented in global shipping reviews by organizations like UNCTAD’s Review of Maritime Transport, so maintaining export competitiveness requires continual efficiency gains.

Cash‑flow strain in capex phase: Despite low leverage, recent commentary and data show periods of negative operating cash flow as CSL funds heavy capex on ISRF, the new dry dock and greenfield projects, which heightens sensitivity to execution delays.

## FAQ: Cochin Shipyard Share (2026)

### Why is Cochin Shipyard share rising around Jan 30, 2026?

Because the company announced a new “Green Tug” order from Polestar Maritime in the ₹100–250 crore range and a ₹3.50 interim dividend, easing concerns after weak Q3 FY26 margins.

### What is the dividend record date in 2026?

The record date for Cochin Shipyard’s second interim dividend of ₹3.50 per share for FY 2025–26 is 3 February 2026, as per its board and exchange filings.

### Is the Q3 FY26 profit drop permanent?

The Q3 FY26 profit fall looks mainly mix‑driven—more lower‑margin shipbuilding, less high‑margin repair—plus higher costs, not a confirmed permanent decline.

### Is Cochin Shipyard a good long‑term investment?

The business is attractive long term—strong order book, policy support, conservative balance sheet—but the stock looks expensive at current P/E and compressed margins, so disciplined entry on corrections is wiser.

Author Bio

Global Marketing Guide is a blog that uses publicly available information and AI assistance to break down complex stock and sector updates into simple, easy‑to‑read articles for retail investors.

Disclosure

This report is for informational and educational purposes only and does not constitute financial advice or a securities recommendation. The author held no positions in Cochin Shipyard or its mentioned peers as of January 30, 2026. All data is taken from stock‑exchange filings, government or regulator releases, and reputable financial news sources and may change over time.